Learning Center Ascending Triangle

In this case, the followup is usually a strong move lower as the buyers missed their chance to continue the uptrend. Thus, this is the main strength of the ascending triangle – ascending triangle pattern it helps the uptrend to extend. Due to the existence of two trend lines, we are in a better position to determine the take profit and stop loss, if the pattern is activated.

Within the symmetrical triangle, the price forms higher lows and lower highs. There’s no clarity on the market’s further direction, and traders simply wait for the breakout. If the price breaks above the resistance level, the market will move upward. Each new test of the resistance area has the potential to break out, but traders should be wary of false breakouts. A sustained breakout will typically be accompanied by above-average trading volume. The closer the ascending trendline comes to meeting the horizontal resistance line, the more likely a breakout is to occur.

In this guide, we’ll explain what ascending triangle patterns are and how to trade them. To illustrate the application of the ascending triangle pattern to forex trading, consider a hypothetical trade setup as follows. Read on if you find the ascending triangle intriguing and want to see how it fits into your forex trading strategy. An example is the best way to understand what the pattern looks like on a price chart.

For long setup, slot loss order can be kept at the previous swing low of the triangle. It represents the indecisiveness between the buyer and seller as both are not showing any interest in the current price. Triangle pattern has a higher success rate as compared to other patterns. Jesse has worked in the finance industry for over 15 years, including a tenure as a trader and product manager responsible for a flagship suite of multi-billion-dollar funds. In this example, the height of the widest portion of the triangle is roughly $20 ($280 less $260). The $20 provides a rough approximation of how much further the price could fall.

Step 3: Enter a Trade

The upper trendline, which was formerly a resistance level, now becomes support. The upper trendline must be horizontal, indicating nearly identical highs, which form a resistance level. The lower trendline is rising diagonally, indicating higher lows as buyers patiently step up their bids.

The advice, suggestion and guidance provided through the blogs are based on the research and personal views of the experts. Target in rectangle formation is based on the depth of the rectangle pattern. For a short setup, a slot loss order can be kept at the previous swing high of the triangle.

How to identify an Ascending Triangle Pattern on Forex Charts

An ascending triangle pattern is produced when a horizontal line can be drawn along the highs of a price chart, and an upwards-sloping line can be drawn along the price lows. An ascending triangle implies the formation of an upper price resistance, at which at least two points touch at a short distance from each other. As well as the formation of rising lows between these points, there is a support level sloped up. With a rising wedge, trading and pattern formation occurs on increased volumes.

- Clients must consider all relevant risk factors, including their own personal financial situation, before trading.

- Now, let’s go through some stuff that will make the triangle pattern easier to be understood.

- The next thing you want to see in a breakout is for volume to accelerate on the move higher.

- So, below, we are going to show you two basic but effective strategies to use when you identify the ascending triangle pattern.

Normally, the ascending triangle is a bullish pattern because it’s most common to appear within an uptrend. However, there are some instances where the ascending triangle can act as a bearish pattern. The second element of the ascending triangle is a slanting or a rising trendline moving upwards. The triangle chart pattern is generally considered a bullish pattern.

What Is a Triangle Chart Pattern?

We will enter into a trade only when breakout/breakdown is confirmed by price trading above the high of the breakout candle. WallStreetZen does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. Information is provided ‘as-is’ and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data. Typically, proponents of this technical tool calculate price targets by adding or subtracting the height of the thickest part of the triangle to or from the breakout point. Therefore, before trading on a real account, you can test your skills and gain experience in trading without any risks on a free LiteFinance demo account.

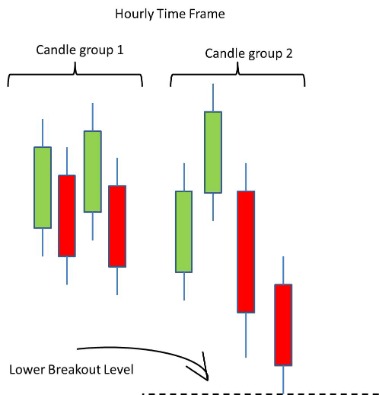

IU offers 3 trading courses with a track record of transforming brand-new traders into full-time trading professionals. On the hourly chart of the US dollar index, you can see the ascending triangle. HowToTrade.com helps traders https://g-markets.net/ of all levels learn how to trade the financial markets. In the chart above, you can see that the price is gradually making lower highs which tells us that the sellers are starting to gain some ground against the buyers.

Infosys, M&M, Indian Hotels: How should you trade these buzzing stocks – Business Today

Infosys, M&M, Indian Hotels: How should you trade these buzzing stocks.

Posted: Thu, 31 Aug 2023 02:25:45 GMT [source]

You can time your trades with this simple pattern and ride the trend if you missed the start of the trend. Next, we’ll jump to a simple breakout trading strategy that will teach you how to identify and trade the ascending triangle formation. Unlike in an uptrend, when the ascending triangle pattern develops within a downtrend it’s more likely to signal a reversal than a continuation.

Head and Shoulders Pattern: Reversal Stock Trading Pattern Overview

Both of these triangles are continuation patterns, except they look differently. The descending triangle has a horizontal lower line, while the upper trend line is descending. This is the opposite of the ascending triangle which has a rising lower trend line and a horizontal upper trend line. The biggest limitation of the bullish triangle, as it’s the case with other types of triangle, is a false breakout. The price action may move above the resistance line, just to return below, and hit a stop loss. The main problem with triangles, and chart patterns in general, is the potential for false breakouts.

- Ascending triangles typically form after a strong uptrend, not after sideways price action.

- In this case, we would set an entry order above the resistance line and below the slope of the higher lows.

- The ascending triangle is a pattern you should familiarize yourself with when trading.

- The lower line is a support level in which the price cannot seem to break.

Using the same example, we will now showcase how to trade the ascending triangle. As soon as there is a breakout, which is confirmed with a close above the resistance line, we may consider entering the market on the long side. As with every candlestick pattern, we have two options for the entry – immediately after the breakout candle closes, or waiting for a potential throwback.

The greater the number there are, the clearer this horizontal line becomes and so will the ascending triangle pattern be considered more reliable. These swing highs do not have to exactly meet the horizontal resistance, but should be seen to be around the zone. The ascending triangle is a pattern you should familiarize yourself with when trading. It’s important to understand the most popular chart patterns in the market in order to better understand price movement.

Remember, with technical analysis, if you don’t keep it simple, you will begin to see things that aren’t even there on the chart. Chart patterns usually occur when the cost of an asset goes towards a direction that a common shape, like a rectangle,… A step by step guide to help beginner and profitable traders have a full overview of all the important skills (and what to learn next 😉) to reach profitable trading ASAP.

Ascending and descending triangles are the opposite types of the triangle pattern. Successful trading relies on having good information about the market for a stock. Price information is often visualized through technical charts, but traders can also benefit from data about the outstanding orders for a stock.