WACC Formula, Definition and Uses Guide to Cost of Capital

Content

Determine your effective interest rate by adding together all that interest by the total amount of debt you owe. The after-tax cost of debt is the interest paid on debt less any income tax savings due to deductible interest expenses. To calculate the after-tax cost of debt, subtract a company’s effective tax rate from one, and multiply the difference by its cost of debt.

If a company is public, it can have observable debt in the market. We can look at the company’s bonds and use the values mentioned above to solve for the YTM of the bond. It is best to use this method when the company you are looking at has a simple capital structure. If it has a more complicated capital structure with multiple tranches of debt, there will be multiple differing interest rates. Others may want to know your company’s cost of debt figures, because it can help them assess the risk of doing business with your company.

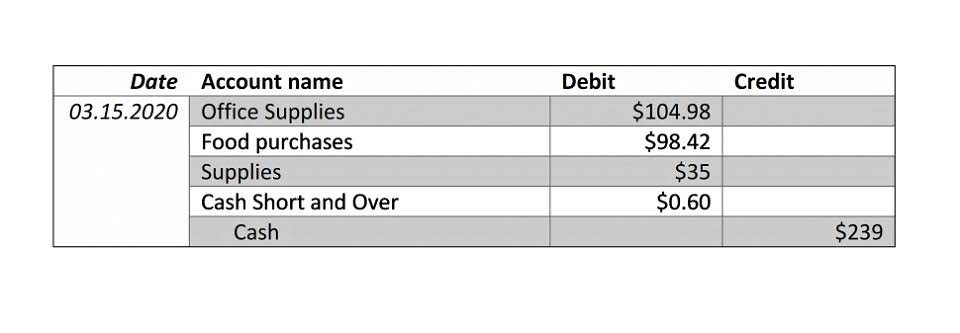

Calculate After-Tax Cost of Debt

A company will commonly use its WACC as the hurdle rate for evaluating mergers and acquisitions (M&A), as well as for financial modeling of internal investments. The equity risk premium (ERP) is defined as the extra yield that can be earned over the risk-free rate by investing in the stock market. One simple way to estimate https://www.bookstime.com/articles/days-sales-in-inventory ERP is to subtract the risk-free return from the market return. This information will normally be enough for most basic financial analysis. However, estimating the ERP can be a much more detailed task in practice. Generally, banks take the ERP from publications by Morningstar or Kroll (formerly known as Duff and Phelps).

Suppose that a company obtained $1 million in debt financing and $4 million in equity financing by selling common shares. E/V would equal 0.8 ($4,000,000 ÷ $5,000,000 of total capital) and D/V would equal 0.2 ($1,000,000 ÷ $5,000,000 of total capital). WACC is also important when analyzing the potential benefits of taking on projects or acquiring another business. For example, if the company believes that a merger will generate a return higher than its cost of capital, then it’s likely a good choice for the company. If its management anticipates a return lower than what their own investors are expecting, then they’ll want to put their capital to better use. A high WACC means it is more expensive for a company to issue additional shares of equity or raise funds through debt.

Calculating the Cost of Debt

The pretax cost of debt is equal to the after-tax cost of debt, so it makes no difference. If you only want to know how much you’re paying in interest, use the simple formula. Like any other cost, if the cost of debt is greater than the extra revenues it brings in, it’s a bad investment. Federal Reserve, 43% of small businesses will seek external funding for their business at some point—most often some kind of debt. Knowing the after-tax cost of the debt you’re taking on is crucial when trying to stay profitable.

- The cost of equity doesn’t need to be paid back each month like the cost of debt.

- The cost of debt refers to the effective interest rate paid on the company’s total debt.

- As the company pays a 30% tax rate, it saves $1,500 in taxes by writing off its interest.

- By contrast, a higher WACC usually coincides with businesses that are seen as riskier and need to compensate investors with higher returns.

Put simply, the cost of debt is the effective interest rate or the total amount of interest that a company or individual owes on any liabilities, such as bonds and loans. This expense can refer to either the before-tax or after-tax cost of debt. The degree of the cost of debt depends entirely on the borrower’s creditworthiness, so higher costs mean the borrower is considered risky. Determining the cost of debt and preferred stock is probably the easiest part of the WACC calculation. Similarly, the cost of preferred stock is the dividend yield on the company’s preferred stock.

Cost of Debt Calculation Example

Debt is a vital component of a company’s capital structure in terms of using various funding sources to fund its operations and keep the business growing. Therefore, companies should understand how much they need to pay for debts to determine if they can pay all debt costs. The cost of debt is the effective interest rate a business pays on its obligations to creditors and debtholders. It is an expected rate of return for the companies that provide credits and debt and is expressed as a percentage.

The formula for calculating the cost of debt is Coupon Rate on Bonds x (1 – tax rate). Conventional financial wisdom recommends that companies establish a balance between equity and debt financing. It’s crucial to choose the options that are most suitable for your staff, shareholders, and existing clientele.

WACC Part 1 – Cost of Equity

Then, find interest expense on the company’s most recent annual income statement to find the dollar cost of debt over the period in question. The critical difference between these sources of funding is the cost of capital is the required rate of return on shareholders’ investments. Therefore, cost of debt formula the company can determine the risk they take to finance its debts and loans compared with other companies in the market. Companies with the highest debt cost are known as risky companies. Debt cost includes the amount the company borrows with interest required by the creditors or bondholders.